This editorial appeared in the January 23rd, 2025, issue of the Topline newsletter.

Want all of the latest go-to-market insights without the wait? Subscribe to Topline and get the full newsletter every Thursday—delivered a week before it hits the blog.

Recurring revenue changed everything in tech. The ability to start each year with predictable income unleashed a wave of innovation that created trillions in market value. It was beautiful – and it was just the beginning.

Cloud computing birthed the SaaS revolution. Now AI is driving the next great platform shift, pushing software towards usage-based pricing. But, while 61% of SaaS companies have already made this leap – including over half of the fastest-growing players – there's a costly disconnect hiding in plain sight.

Sales compensation is stuck in 2010.

"But wait," you say, "we added consumption targets to our comp plan last quarter!" Sure, and Blockbuster added streaming in 2010. Sometimes being a little bit right is just as dangerous as being completely wrong.

This isn't just about tweaking commission structures – it's about fundamentally reimagining the role of sales. In a usage-based world, the initial deal is just the beginning. Real success demands reps who think like portfolio managers, not deal hunters. They need to map out expansion paths before the ink dries, build deep relationships across customer organizations, and stay engaged long after the champagne pop.

But here's the reality: your reps will only do what you pay them to do. And right now, you're paying them to close and ghost.

The Million-Dollar Gap

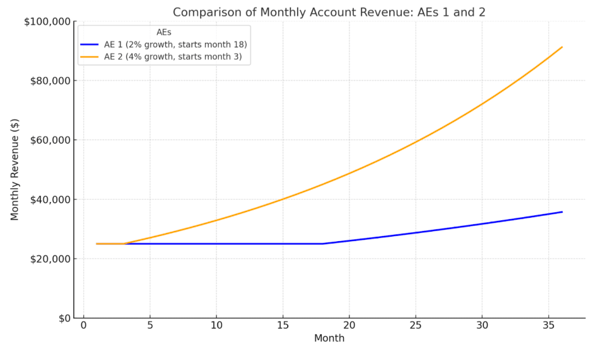

Let’s look at two enterprise deals at a high-growth SaaS company – identical $300K initial commitments, same product, same customer profile. The only difference? The compensation structure of the reps who sold them.

Rep A worked under what most companies consider a "modern" comp plan: base commission plus a bonus for Year 1 consumption targets. They ran the standard playbook. Checked the discovery boxes. Got the business case approved. Navigated procurement. Deal went live on schedule, and they moved on to the next target.

Rep B had a different incentive structure: compensation tied to three years of customer consumption. Same strong sales motion, but with a crucial difference in approach:

- Deep mapping of potential use cases across the organization

- Strategic stakeholder alignment beyond the buying committee

- Collaborative implementation planning with customer success

- Ongoing engagement through the deployment phase

- Minimal discounting – after all, they had three years of comp on the line

Here's where it gets interesting. By month three, Rep A's deal was technically "successful" – the customer was using the product and hitting minimal consumption targets. Classic "land and expand" territory, right?

Meanwhile, Rep B's customer was already expanding into two new departments. By month six, their consumption was 40% above initial commitments. The gap only widened from there.

The revenue difference by year three? A staggering 80%. The "successful" traditional deal generated $996K. The deal sold with long-term incentives? $1.8M.

This isn't an outlier. It's simple behavioral economics. When you incentivize short-term thinking, you get short-term results.

The Wealth Manager Model

The solution requires looking outside the SaaS bubble. Wealth managers and insurance agents cracked this code decades ago: let your top performers build a book of business. Their compensation extends years beyond the initial sale, creating a natural flywheel of referrals, expansions, and compound growth.

When it works, it's magic. At my last company, we threw out the traditional playbook and implemented something radical. The blueprint:

- 5% commission on projected Year 1 revenue

- 3% on actual consumption for Years 1-3

- 1.5% on Years 4+ consumption

- Performance gates to maintain the residuals

The results? We scaled from $28M to $170M in four years while maintaining 120%+ net revenue retention. Even more telling: only 3 regrettable sales departures in that entire run.

Beyond the Band-Aid

The shift to usage-based pricing isn't just another SaaS trend – it's a fundamental reimagining of how software companies grow. Yet most are still trying to retrofit old compensation models with consumption "patches."

Want to build a real growth engine? Let your best reps build equity in their customer base. Give them skin in the long-term game. The market is already moving in this direction – the only question is whether you'll lead the shift or play catch-up.

Matt Braley has over 15 years of experience in enterprise software. Most recently, he spent 11 years at Invoice Cloud, where he started as an AE and rose to become the company's first CRO. There, he led GTM from $28M to $170M and a successful IPO. Matt has a passion for value selling, team building, and crushing the competition. Currently, he is serving as an advisor to growth-stage companies.