Working uniquely with businesses at what we define as the emerging growth phase of company development at PeakSpan means that every company we partner with has answered a lot of the existential questions startups are faced with:

Can we build it? Will they buy it? Can we sell it on terms that make sense for us as a business?

These fundamental issues – related to core technology/product, market opportunity/adoption, and business model viability – represent binary risk levers. They simply must be satisfied, or they will kill the company.

Navigating the whitewater rapids of the startup phase successfully means you’ve worked hard to mitigate and strip away those binary risk vectors. That’s the point in the company journey arc where we come in. While the next leg of the voyage is certainly no easier, less grueling, or without risk, the type of risk encountered is very different.

The scaleup phase is all about moving from ad hoc to repeatability, from volatility to consistency, and from creative and scrappy to systematized and process-centric. Success involves intentionally placing bets in the right places, doubling down at the right times, and understanding the natural limitations of what the business can palpably digest without self-inflecting debilitating levels of indigestion.

At the end of the day, making the right decisions related to where to add resources, ramp up investment, and expand the team is only half the battle. No matter how attractive a market opportunity may be, how differentiated a platform appears, and how much capital a company has access to if your team can’t execute, nothing else matters. Sustained execution is as critical as anything else in growth company development. It’s an essential ingredient in the recipe for resilient value creation. And sales execution in particular will end up either inhibiting or driving the ultimate value any business will achieve.

Strong sales execution is the result of so many nuanced variables which can vary dramatically based on value proposition, price point, industry vertical, etc., making it impossible to develop a playbook and prescribe an approach that will work for every company. Different GTM organizations – and the individual sellers comprising them – operate in different ways, using different tools, and employing different strategies. However, there are a few things that almost all GTM teams need to do to sustain productivity and execute at a high level in the modern era.

First, you need to align on your ideal customer profile, find them, engage with them, and track the progress of those engagements. Next, you need to learn how to engage most effectively, and continuously refine and optimize your approach. Finally, if all else goes well, you need to get prospects to sign on the dotted line, and hopefully do so again and again in the future to maintain and expand the relationship.

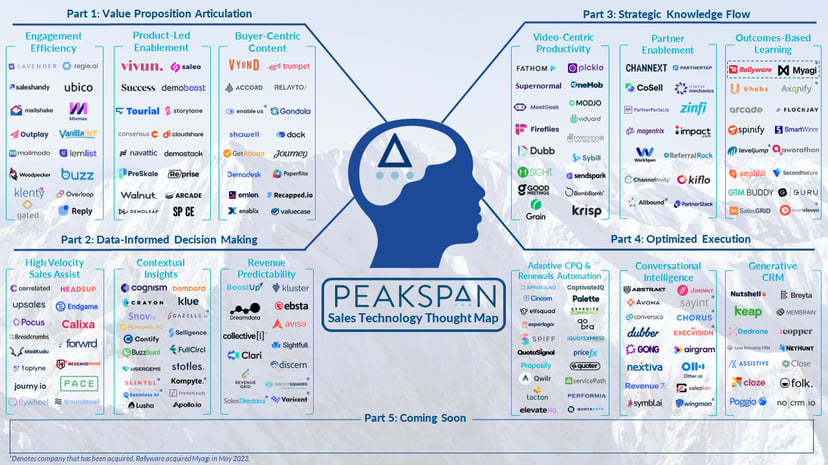

There is a lot more to it than that of course, but all of these things are unequivocally critical ingredients to achieving success and sustaining execution as a GTM organization. The next installment of our thought map series explores three sub-segments of the sales tech universe which are aimed at software enabling these essential drivers of best-in-class sales execution.

Salesforce turns 25 in February of next year and is arguably the most influential B2B software business that has come onto the scene over that time. They created the modern CRM market as we know it today, have dominated it for nearly two decades, and have played an instrumental role in establishing SaaS as a household acronym understood well beyond the tech community. Salesforce is synonymous with CRM, and deservedly so – the company has more market share than the next four vendors in the space combined.

The ways by which organizations record, track, and manage their customer relationships have transformed as dramatically as any other component of sales over the last five decades. The note card-laden Rolodex of the 1950s gave way to the introduction of mainframes in the 1970s and databases in the 1980s, all of which were precursors to the first “contact management software” platform launched by Conductor Software in 1987 and subsequently, the first “sales force automation” platform, pioneered by Siebel in 1995.

Marc Benioff founded Salesforce in 1999 and 20 years later it became the first cloud computing company to breach $1 billion in revenue. After 73 straight quarters of revenue growth – yes, that is over 18 years, and yes, that’s a mind-blowing statistic – Salesforce surpassed SAP in Q2 2022 to become the largest enterprise software company in the world. Salesforce’s revenue today is north of $30 billion.

To say the 2023 version of Salesforce’s CRM platform barely resembles the solutions brought to market by the early entrants not too long ago is a laughable understatement. Both the company’s financial performance and platform breadth/depth have been expanding at near-exponential rates. As one might expect from a company that has increased revenue by a factor of more than 600x in the last two decades, Salesforce has driven immense transformation in the space along the way. Love them, hate them, love to hate them… it doesn’t matter; the impact SFDC has had is undeniable.

And yet, despite the magnitude of change the category has undergone since the company stepped onto the field, the pace of innovation we are witnessing now is so significant that we believe it has the potential to nurture category evolution in the next 20 years which is even more dramatic. Over the last 10 years, AI has outperformed Moore’s Law – the longest-standing assertion related to the pace of technology innovation which suggests that computer performance (speed, processing power) will double every two years. While this was largely on point for the last 50 years, the performance of AI systems has been doubling every six months for the last decade.

We’re calling this disruptive next-generation segment Generative CRM, which we believe is apropos and descriptive of the value proposition these avant-garde platforms seek to deliver.

Generative AI has rapidly become the most pervasive buzzword in Silicon Valley, and for good reason, as it pushes technology beyond observation, analysis, and insight, to creation for the first time. Early applications of Generative AI are primarily focused on creating data and content in the form of bespoke text, vibrant imagery, dynamic audio/video, and even software code itself. Generative CRM vendors are similarly focused on creation, but instead of data, these businesses are creating revenue opportunities.

Generative CRM platforms work by ingesting all available structured and unstructured data points, contextual cues, and interaction details related to customers and prospects, and then analyzing that information to glean valuable signals from the vast array of noise. These signals independently can be valuable and predictive of a prospect’s propensity to engage or an ICP’s intent to buy. But Generative CRM platforms take it a step further and examine not just what these signals independently imply, but what the interactions of those various signals together suggest on a multi-variate basis.

Similar to the movie Inception, in which the main characters leverage a futuristic technology solution to extract valuable pieces of information from “a dream within a dream”, these platforms seek to reveal valuable revenue opportunities by examining the “signal within the signals”. This is incredibly powerful, as it enables GTM teams to attack opportunities based on things that were previously unknowable.

The most consistent, predictable, productive sales organizations – and the best-performing sellers – commit to an ethos of continuous improvement, constantly seeking to enhance tactics and employ new strategies to optimize execution. Operationalizing this mindset requires adopting training and coaching as ongoing priorities and always-on initiatives, learning in real-time what is working and how to tweak/enhance the approach accordingly.

Even the best sales leaders only have so many hours in the day to shadow the sellers on their teams and listen in on calls/meetings to provide feedback to help them improve their skills. Software has enabled GTM organizations to complement human effort with machine learning to analyze not just a handful of interactions, but every single word spoken across every touchpoint with a prospect.

Gong has quickly become one of the leading “new incumbents” in this area, as conversational intelligence has ascended to become a table-stakes competency for organizations of all shapes and sizes today. This category is still nascent and burgeoning, and the ability to seamlessly integrate systems of record being used across the enterprise now enables businesses to “listen” to data being produced across all functional groups and incorporate key learnings, effective positioning, and current messaging into their GTM strategies.

Technology should always be an enabler of success, not the primary driver of that success. Leveraging software to complement the efforts of the team – not replace them – has proven to yield some of the most strategic applications of innovation that we’ve seen. Freeing up time so team members can spend every waking minute on the highest value activities – things the robots can’t do (yet) – delivers clear, tangible value, and this segment is a great example of that. Enabling a VP of Sales to spend as much time as possible engaging with their team and coaching their reps to develop their higher-level skills versus wading through hours and hours of conversational data in the hopes of extracting pertinent actionable insights is incredibly strategic and will be for years to come.

Friction is the enemy of execution in any sales process, regardless of sales cycle length, price point or industry vertical. The last step in the process of any sale is the proposal stage, and when a prospect raises their hand to say they’re ready to buy, you need to be ready to present a framework that makes sense, share it with them in a digestible format, and maintain agility by being able to react/respond to make changes quickly and efficiently as you drive to closing.

While the longstanding configure, price, and quote (“CPQ”) arena rarely graces the cover of TechCrunch, we believe the innovation happening in this segment is notable. Several vendors in the space are catalyzing a transformation of the status quo, evolving from PDFs being the predominant medium for contracting to a modern, dynamic format that is integrated into all relevant systems of record (CRM, accounting/finance, ERP) to ensure changes made to a given proposal ate automatically tracked across the business.

Inking the initial deal, however, is only half the battle. Software-as-a-Service is aptly named… SaaS vendors are not selling hard iron on-premise in a one-time fashion and then collecting 20% maintenance thereafter. SaaS is definitionally software sold as a service, priced as a recurring subscription. By virtue of that, maintaining, renewing, and potentially expanding a customer’s business is something that needs to be earned continuously.

Providing ongoing value and securing the renewal of course involves engagement from numerous functional groups (Customer Success, Account Management, Product, Finance), but the same notion noted above to begin the section remains true in the land of renewals/upswells – friction is the enemy of execution.

Modern enterprises now leverage dozens and dozens, sometimes hundreds, of software products to supercharge their efforts. As a result, simply getting ahead of what subscriptions need to be renewed, when, and for what amount, can be a daunting task to manage. Fortunately… there’s now software for that! A new crop of vendors has emerged in recent years focused on automating the renewal/upsell process, improving the experience for both customer and provider by removing friction wherever possible. Today, this primarily involves providing the buyer with all relevant information required to make the keep, cut, or buy more decision, and ultimately making the (re)purchase process itself as seamless as possible.

Human beings increasingly prefer to self-educate and self-serve, more frequently demonstrating a propensity to avoid human interaction and drive decisions in a self-guided manner wherever possible. The vendors in the burgeoning renewals automation segment that we have been impressed with cater to that propensity and deliver mind-boggling ROI to their customers in the process. While at first blush the value proposition espoused by these platforms may seem tactical, make no mistake about it – reducing friction across the buying/renewing/upselling journey is highly strategic, and the momentum the early leaders in the space are experiencing is the pudding that bears the proof.

Similar to the Revenue Predictability segment discussed in part two of the thought map series, a tangential but very important benefit these solutions deliver is their ability to support customers in becoming more dynamic, real-time, and data-informed in their forecasting and budgeting approach. Moving towards an agile forecasting methodology enables organizations to be more deliberate and intelligent in their resource allocation decisions.

Missed a part of our series? Review Part 1: Value Proposition Articulation here, Part 2: Data-Informed Decision Making here, and Part 3: Strategic Knowledge Flow here.

Stay tuned for the fifth and final installment of the thought map series… coming soon!