Economic volatility is nothing new to go-to-market (GTM) leaders. But the recent escalation in tariff policy—and the speed at which trade regulations are changing—has ushered in a new era of uncertainty for B2B tech companies. Regardless of where your company sits in the value chain, the second- and third-order effects of these changes are already beginning to show up in pipelines, sales cycles, and strategic planning.

To help executive leaders make sense of this shifting landscape, Pavilion recently hosted a roundtable featuring insights from Mike Hoffman (CEO) and Tony Erickson (Managing Partner) of SBI, Growth Advisory. Drawing on CEO survey data, public SaaS benchmarks, and their work advising hundreds of B2B companies, they unpacked the implications for commercial strategy—and offered pragmatic next steps for GTM leaders focused on protecting growth and improving efficiency.

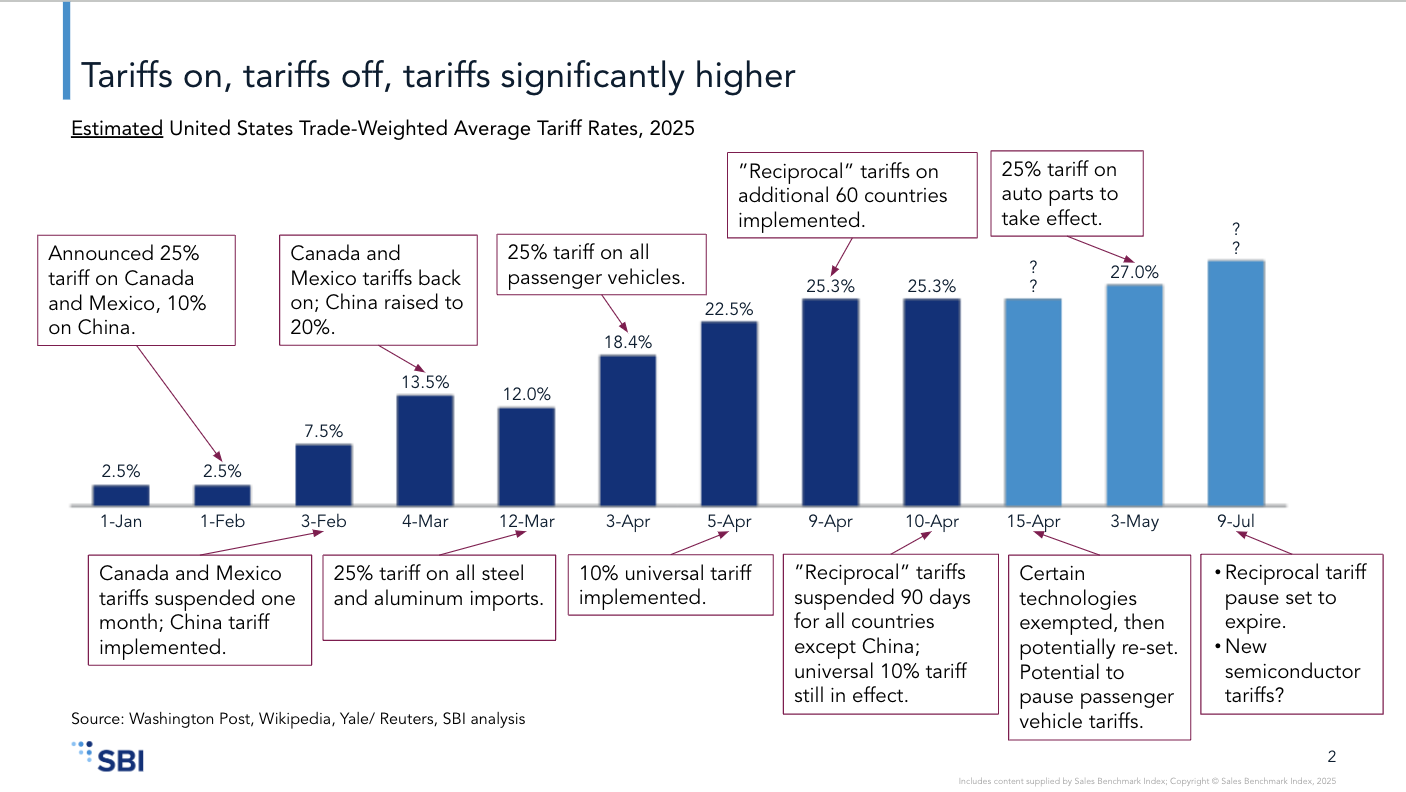

As of April 2025, the U.S. trade-weighted average tariff rate has increased from 2.5% to over 27%, following a series of staggered policy announcements affecting dozens of countries and sectors. Certain technologies have been exempted and re-evaluated in real-time, creating further confusion for importers and exporters alike.

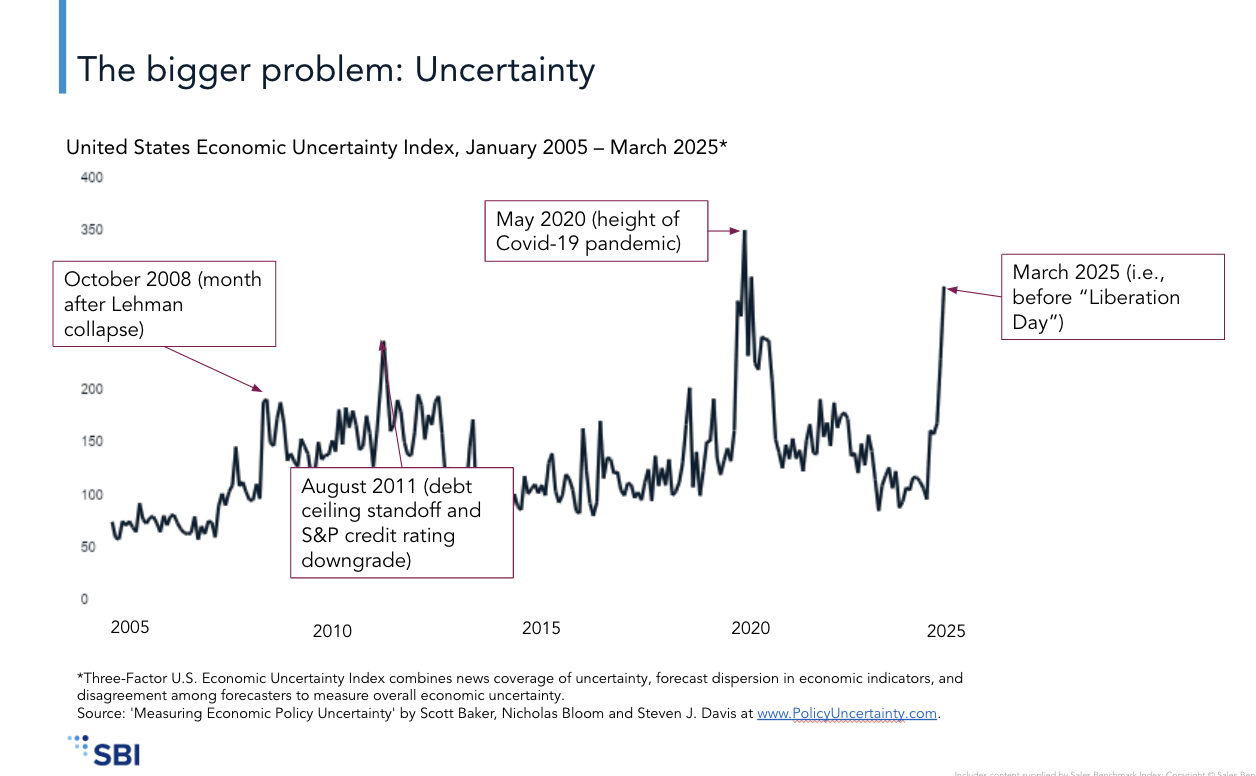

But the policy complexity is just one part of the story. The bigger challenge is the macroeconomic uncertainty these changes have triggered. According to the U.S. Economic Policy Uncertainty Index—an aggregate of media sentiment, economic forecasts, and forecaster disagreement—uncertainty levels in March 2025 approached those seen during the 2008 financial crisis and the early days of the COVID-19 pandemic.

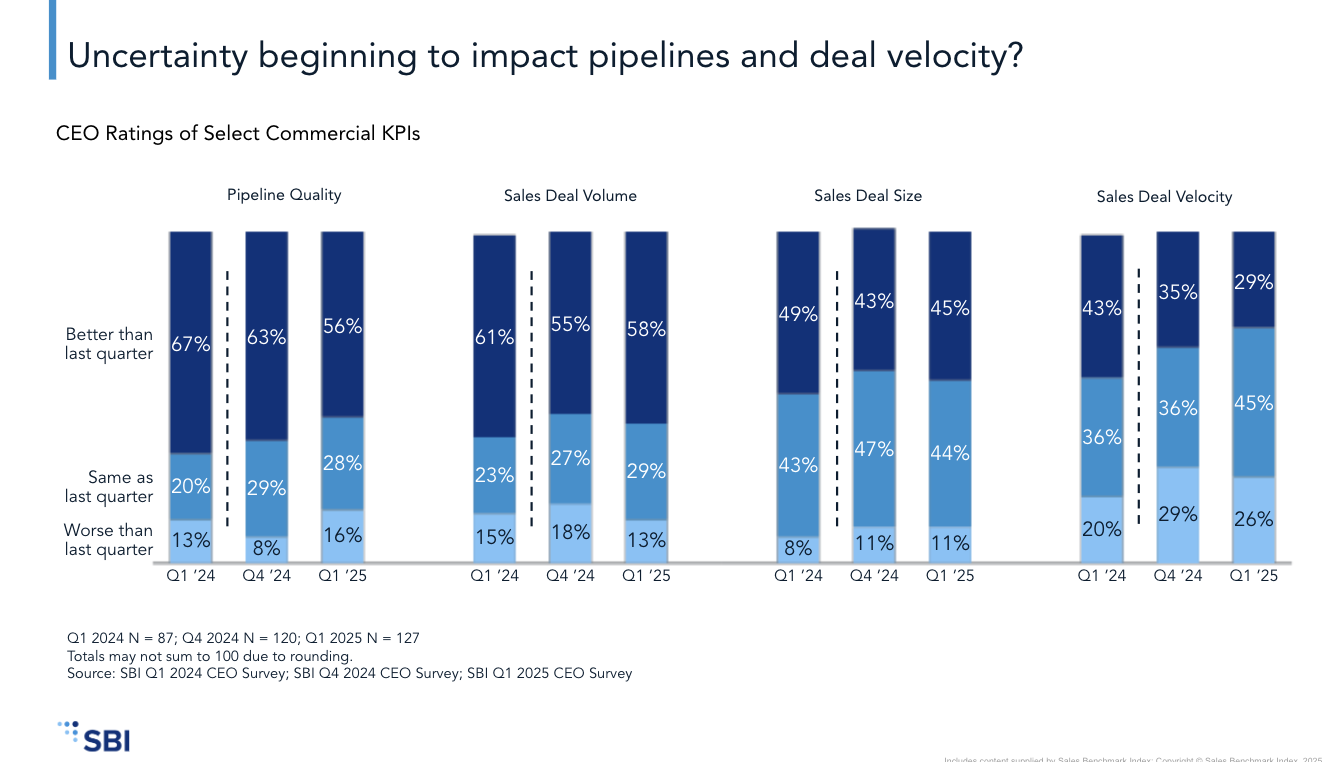

This climate is having measurable effects on GTM performance:

The headline: momentum is slowing. Pipelines aren’t evaporating, but decisions are being deferred—and deferred deals are often as damaging as lost ones.

For many B2B tech companies, especially those offering SaaS products, the assumption has been: “We don’t manufacture goods, so tariffs don’t impact us directly.” That’s technically true—but strategically short-sighted.

Many GTM leaders are already seeing impacts through their customers and partners:

Even software companies that rely on offshore development or global support centers are asking important questions: Will future policies extend beyond physical goods? Could offshored services or IP eventually be caught in the net?

These indirect effects require every GTM leader to rethink their Ideal Customer Profile (ICP) strategy, with special attention to at-risk verticals and international exposure.

SBI emphasized the importance of scenario planning. If your top vertical is slowing due to procurement freezes or tariff exposure, identify your second-best vertical—one with lighter headwinds and existing traction. Shift GTM resources accordingly: outbound prospecting, paid media, SDR campaigns, and content strategies should reflect your updated segmentation.

Velocity is now the weakest of the four core pipeline indicators (volume, quality, size, velocity). Sales cycles are elongating. Deals are stalling mid-funnel. To regain momentum, SBI recommends focusing on two higher-performing sales archetypes:

These archetypes are proving more effective than the traditional “Challenger” model in today’s environment.

Many tech companies are rushing to build AI into their product offerings, but fewer are applying AI to improve their own GTM systems. This is a missed opportunity.

SBI recommends building AI-driven playbooks that standardize messaging, certify seller readiness, and enable real-time coaching—without relying on costly enablement headcount. Investments here can create compounding returns on productivity and message consistency.

In an environment where headcount is flat and budgets are under scrutiny, pricing becomes one of the few controllable levers. But not all pricing exercises are created equal. The most effective GTM leaders are using pricing to:

These are not back-office exercises—they’re front-line revenue strategies.

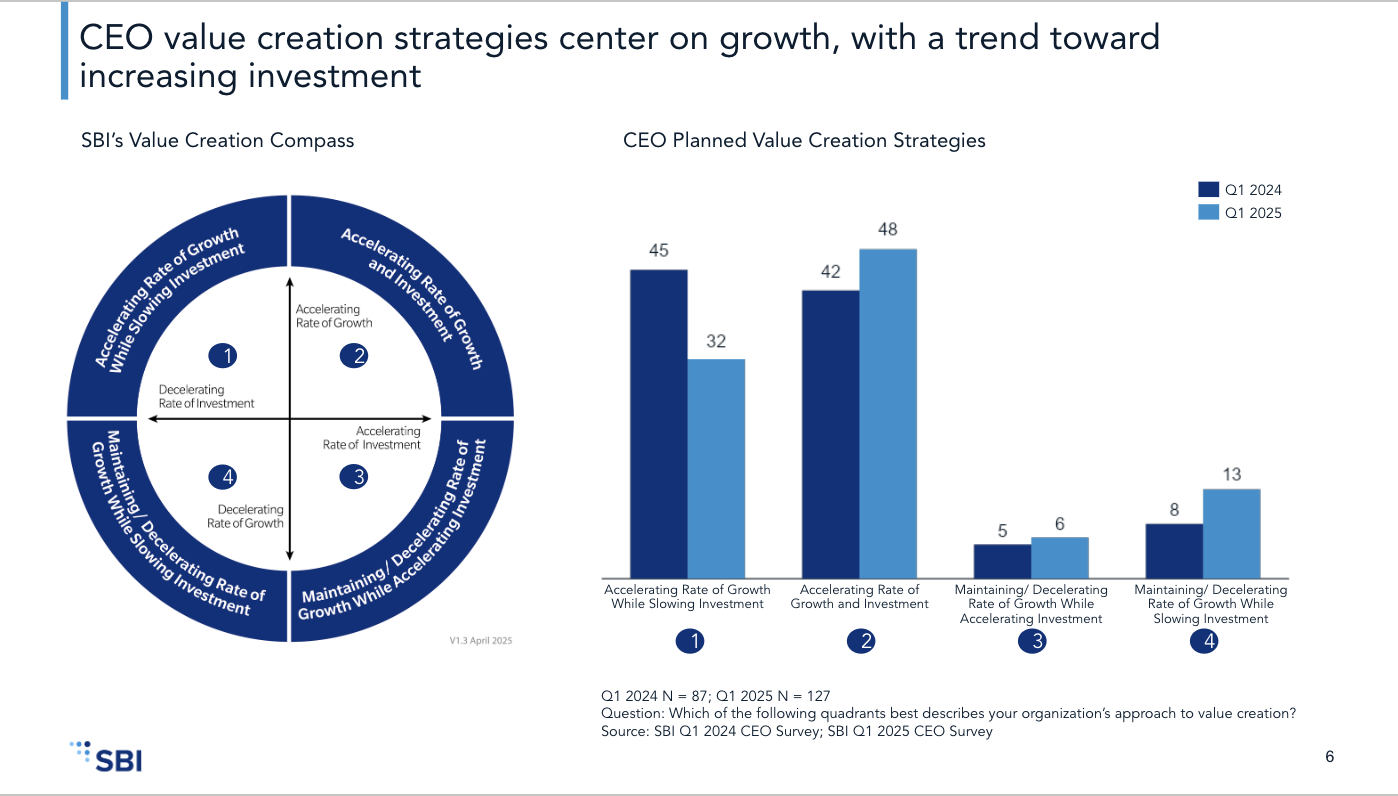

Despite the noise, the outlook isn’t entirely grim. In fact, SBI’s CEO survey data shows an increase in executives who plan to grow both revenue and investment in 2025 compared to 2024. The focus is shifting from pure cost-cutting to selective reinvestment, especially via tuck-in acquisitions and self-funded efficiency gains.

However, funding for new GTM initiatives remains constrained. With sales and marketing expenses growing at just 5% in 2024 (compared to 31% in 2021), the imperative is clear: growth must come from better execution, not just more spend.

Tariffs may shift. Policy may pivot. Markets may surge or slide. These are macro-level forces outside any GTM leader’s control. But the strategy you execute? That’s yours.

As SBI put it: “This is gravity. You can’t change it—but you can change your posture.”

That means aligning GTM strategy to where demand is flowing, not where it used to be. It means reshaping teams and territories based on today’s data, not last year’s plan. And it means getting closer to your customer—understanding their priorities, pressures, and politics—so you can be indispensable when it matters most.

The takeaway? Uncertainty is a given. Strategic clarity is a choice.

This article is based on insights shared during a Pavilion Executive Roundtable hosted in partnership with SBI Growth Advisory. Slides and supplemental resources, including sales archetype frameworks, will be shared with all Pavilion members.